Construction Scenarios: AI and Technological Opportunity

In one of those interesting

accidents of timing, reports from the two leading management consultancies on

the future of construction were released within days of each other. These are briefly

summarised below. Also, some quotes from interviews with people on new technology

and their projects, with some comments and observations to close.

From management consultants

McKinsey comes the latest in their series of reports on technology and construction,

this one titled Artificial Intelligence: Construction Technology’s Next Frontier,

the first major publication specifically on the industry-wide implications of

AI that I know of. This is one of a series of recent papers on AI, automation and infrastructure.

The World Economic Forum and the

Boston Consulting Group released their Shaping

the Future of Construction report

in 2016, with some interesting examples of frontier firms. They have published

a scenario analysis as the second, final step in their Future of Construction

project, which has involved people from industry and researchers from a wide

range of organizations. The three Future Scenarios they describe make

technological context central to the future form of the industry.

As an adjunct to these two

reports, the views and comments by the managers in their interviews in

Infrastructure Intelligence’s Toward Digital Transformation provide

a nice counterpoint to the somewhat stilted language found in management

consultese. All three were published simulaneously and contain a lot of boilerplate about change management,

agility, recruitment and talent management but, despite the importance of organizational

structure and the development of skills if you want to compete for the future, this is not discussed here.

*

McKinsey identifies five AI-powered applications, and use cases that have

already arrived in other industries, that can be applied to construction. This

is a practical approach that seems to target major contractors, and is a

different approach to previous reports that could have been primarily intended

for public sector clients. McKinsey has been seriously developing their

infrastructure practice for some years now, positioning themselves for the

global infrastructure boom they forecast over the next few decades. The five

industry applications are:

Transportation route optimization algorithms for project

planning optimization;

Pharmaceutical outcomes prediction for constructability

issues;

Retail supply chain optimization for materials and

inventory management;

Robotics for modular or prefabrication construction and

3-D printing;

Healthcare image recognition for risk and safety

management.

Each

of these has a short discussion with some nice examples of crossover potential.

They are all plausible extensions of current technology, and in robotics, 3-D

printing and drones leading construction firms are already well advanced. Using

AI for optimization is obvious, but it is just as likely construction

contractors will be using logistics firms to manage transport and inventory as

they are to invest in the hardware and software development needed. The

question is whether this makes a convincing case for using AI in construction, or

whether these are the pathways into construction for AI, or the only ones.

McKinsey

also looks at some machine learning algorithms that are more relevant to

contractors, and briefly assesses their potential

engineering and construction applications. Despite their extensive reporting on

BIM elsewhere there is no discussion of the potential use of AI in design and

engineering, or in restructuring processes. They do have a good, generic

framework for types of machine learning, and they suggest algorithms will be useful for:

Refining

quality control and claims management

Increasing

talent retention and development

Boosting

project monitoring and risk management

Constant

design optimization

And then there’s this:

industry

insiders need to look beyond sector borders to understand where incumbents are

becoming more vulnerable and to identify white space for growth. Both owners

and E&C firms can explore nontraditional partnerships with organizations

outside the industry to pool advanced R&D efforts that have multiple

applications across industries.

Not coincidentally, McKinsey might be able

to arrange introductions and facilitate ‘exploration’ and, like many McKinsey

papers, this one reads a bit like a catalogue. However, where the previous reports

in this series have emphasised industry problems, using consolidated industry

data from their client base, this one is full of solutions. While some of these

may be solutions looking for problems there are, nonetheless, many acute

observations in this paper on the range of possibilities AI will offer in the

near future. They have put out a stream of reports on AI over the last few

years.

This is a short paper and light on detail. If

McKinsey has a more interesting story to tell on pathways for AI into

construction it might look something like the scenarios depicted in the WEF/BCG

paper. They use the term Infrastructure and Urban Development Industry (IU) to

describe what I call the Built Environment Sector:

The scenarios

depict three extreme yet plausible versions of the future. In Building in a

virtual world, virtual reality touches all aspects of life, and

intelligent systems and robots run the construction industry. In Factories run the

world, a corporate-dominated society uses prefabrication and

modularization to create cost-efficient structures. In A green reboot,

a world addressing scarce natural resources and climate change rebuilds using

eco-friendly construction methods and sustainable materials. It is important to

keep in mind that the scenarios are not predictions of the future. Rather, they

demonstrate a broad spectrum of possible futures. In the real future, the IU

industry will most probably include elements of all three.

Each scenario is used to extrapolate implications

for the industry, identifying potential winners from technological

transformation, and the range of examples and ideas shows the value of such a widespread

collaboration between industry, government and academia. The WEF does not say

how far into the future they are looking, although it seems a fair bet that it

is a lot further than McKinsey.

Building in a virtual world

Interconnected

intelligent systems and robots run IU

Software players will

gain power

New businesses will

emerge around data and services

Factories run the world

The entire IU value

chain adopts prefabrication, lean processes and mass customization

Suppliers benefit the

most from the transition

New business opportunities through integrated

system offerings and logistics requirements

A green reboot

Innovative technologies, new materials and

sensor-based surveillance ensure low environmental impacts

Players with deep knowledge of materials and

local brownfield portfolios thrive

New business opportunities around environmental-focused

services and material recycling

*

What to make of all this?

Scenarios can be useful thought experiments, but by their nature are limited

because the futures they depict are typically extensions of the present.

Tomorrow will be like today, only more so. And saying AI will be important in

the near future is not particularly insightful, although for some construction

managers may be necessary. Some, however, are already working with digital-twin

projects and restructuring around technological opportunity, as the quotes from

Infrastructure Intelligence’s Digital Transformation

interviews below indicate:

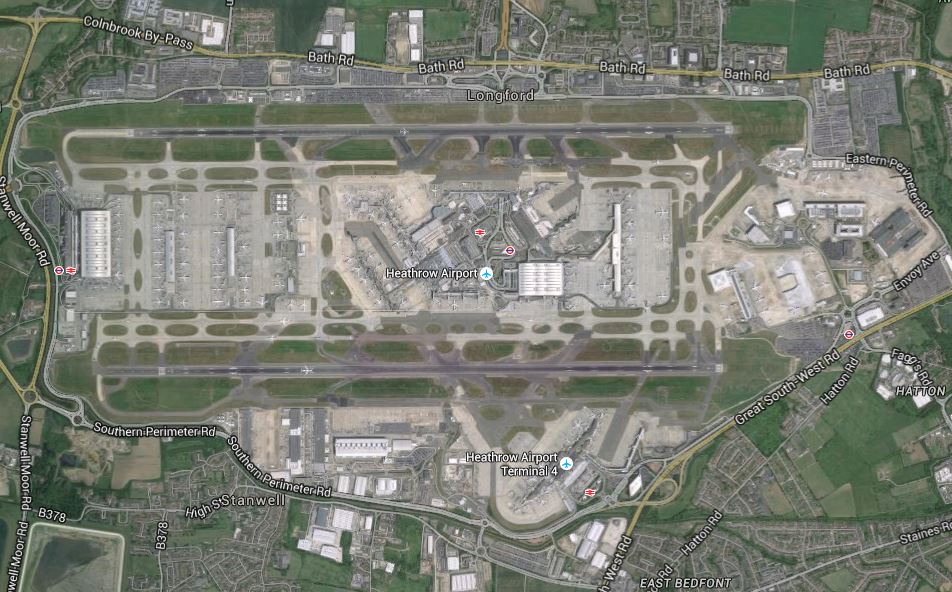

London’s Crossrail and Malaysia’s

Mass Rapid Transit Corporation are two examples that show how “visionary

transportation owners and supply chains are embracing digital technology”, ”moving

beyond 3D modelling and 2D deliverables to enable handover of digital as-built

information to operations.” Steve Cockerell – Bentley Systems

“BIM Wednesdays, where each

Wednesday we got together in a location or had people Skype call in and view

models on smartboards. This meant that when we got to the point of submission

we had collectively resolved all the issues”. Mert Yesugey – Mott MacDonald

“Not knowing where to start is

something we hear often. Just being so overwhelmed with all the technology

that’s available and all the workflow processes. The lessons that we’ve learned

are you must start small with tangible pilots and attack one part of the

workflow at a time, implement technology, create a feedback loop and be able to

measure what’s working and what’s not.” Sasha Reed – Blackbeam

David Waboso

of Network Rail on procurement

based on whole of asset life and outcome based contracts, focusing on in-service

performance and outputs. An example is Resonate’s “Luminate” digital train

management system, “a novel form of contracting that needs only a small upfront

investment and is based a shared benefits agreement whereby the supplier will

be rewarded if the new system delivers performance improvements and a

corresponding reduction in delay compensation payments.”

*

So where is the industry at in

regard to technology take-up, now that there is widespread recognition of the

reality of a digital future? Will construction industry development over the

next decades absorb the impacts of new technology and be gradual, changing

industry practice over time without significantly affecting industry structure

or dynamics? Given the entanglement of economic, social, political, and legal

factors in the construction technological system this might be the case,

however there are good reasons to think this may be wrong. Machine learning,

AI, automation and robotics are an interconnected set of technologies that are

evolving quickly, enabled by expanding connectivity and the massively scaleable

hardware available today.

If we think of the structure of

the industry as a pyramid, there is a broad base of tradesmen and small firms

at the bottom, followed by a deep layer of medium sized firms, and a small top

section with a few large firms. Those large firms and some of their clients are

clearly on the technological frontier, and their investment in capability and

capacity should deliver significant increases in efficiency and productivity,

and probably scale. Some medium-size firms are also making these investments,

and also have access to technologies like algorithmic optimisation,

platform-based project management, robotic, VR and AR applications and so on.

The WEF/BCG Shaping the Future of

Construction report, which is now nearly two years old, included many

snapshots of what a range of firms at the frontier were doing, and some are in the table

below. These sort of examples are missing from McKinsey’s high level analysis,

and reflect the diversity of the industry beyond McKinsey’s potential client

base.

Shaping the Future: Technology,

materials and tools in 2016

Company

|

Example

|

Fluor (US)

|

has built up an

internal team of experts on concrete to advise the client at an early

planning stage, to develop a foundation of data based on experience and to

create a convincing business case for greater use of innovations (such as

50%-faster-curing concrete) in the market.

|

BASF and Arup (Europe)

|

have jointly

developed an app for architects, engineers and project owners to calculate

the energy savings achievable from the latent-heat storage system Micronal.

|

Skanska (Swedish)

|

has developed a new

construction concept known as “Flying Factories”, which are temporary

factories set up close to construction sites; they apply “lean” manufacturing

techniques and employ local semi-skilled labour. The advantages include a

reduction in construction time of up to 65%, a halving of labour costs and a

44% improvement in productivity.

|

Broad Group (China) with ArcelorMittal (India)

|

is using a system of

modular building components that enables very speedy construction: a

57-storey building was built in 19 days by moving 90% of the construction

work to the factory.

|

Komatsu (Japan)

|

is developing

automated bulldozers incorporating various digital systems. Drones, 3D

scanners and stereo cameras gather terrain data, which is then transmitted to

the bulldozers; these are equipped with intelligent machine-control systems

that enable them to carry out their work autonomously and thereby speed up

the pre-foundation work on construction sites, while human operators monitor

the process. On mining sites, autonomous haul trucks are already in common

use.

|

Win Sun (China)

|

has been building 10

houses a day by using 3D-printed building components, and has concluded a

deal with the Egyptian government for 20,000 single-storey dwellings

leveraging this technology.

|

Skanska

|

and its partners are

pioneering the wireless monitoring of buildings, using sensors to record data

(such as temperature and vibration), and wireless equipment to store and

transmit this data. Data analytics are applied to determine the implications

of any changes in the sensor readings. These smart-equipment technologies

have the potential to reduce unexpected failure by 50%, improve building-management

productivity by 20-30% thanks to less need for inspections, and improve the

building’s energy performance by 10% over its lifetime.

|

Atkins

|

has implemented advanced parametric design

techniques for detailed design “optioneering” in the water infrastructure

industry. That has made it possible to provide 22 design options in one day,

a 95% time improvement on traditional design methods for similar results.

|

Arup

|

combines various

data-collection methods, including mobile surveys, security-camera footage

and traffic-flow reports, for improved decision-making in the design of

residential projects.

|

Skanska

|

is developing a Tag & Tack system, pioneering

the use of radio frequency identification (RFID) tags and barcodes on

products and components in construction projects for real-time monitoring of

delivery, storage and installation, the new system is achieving reductions of

up to 10% in construction costs.

|

Source; WEF

Based on these examples, the

level of technology use in construction, compared to advanced manufacturing

techniques in 2016, is well behind. Companies in the aerospace or automotive

industries have developed their automated factories, integration capabilities

and use of new materials like carbon fibre. Adidas makes 300 million shoes a

year and in 2017 opened a fully automated factory in Germany. There are many

examples. The lag is primarily due to the dynamic of a project-based industry,

where it is hard for contractors and consultants to spread costs incurred with

innovation across projects. Consequently, the manufacturers and suppliers of

building and construction products, machinery and equipment do most of the

research and innovation because they, like car companies, can spread the

development costs over many clients. The role of contractors is to seek

efficiencies in delivery, as the examples show. What these examples also show

is that the gap between the industry’s larger, leading edge firms and SMEs is

growing, and can be expected to increase because the great majority of smaller

firms cannot innovate as fast or as effectively as larger firms.

A period of technology-driven

restructuring of the building and construction industry may be about to start,

similar to the second half of the 1800s when the new materials of glass, steel

and reinforced concrete arrived, which led to new methods of production,

organization and management. There are many implications of such a

restructuring. Some firms are rethinking their processes in response to

developments in AI, robotics and automation as capabilities improve quickly and

the range of new products using these technologies expands. Many firms,

however, are not. Meanwhile, frontier firms are exploring new tech and pushing

the boundaries of what is possible, and are inventing new processes.

Other relevant posts:

Construction’s three pathways to

the future here

WEF Shaping the future of

construction here

BIM is essential but not

transformational here

Technological diffusion takes

time here

Disruptive change in

construction here

Frontier firms in construction here