Source: https://www.statista.com/statistics/270233/percentage-of-global-rundd-spending-by-industry/

Construction is in a catch-22 situation, where neither industry incumbents nor its clients can rationally commit to significant, expensive investments in innovation for the vast majority of construction projects. Procurement has a significant effect on technological opportunity and innovation because the effects of appropriability of intellectual property (IP), substitutability between suppliers, and risks associated with innovation for clients are mutually reinforcing factors that have worked against innovation in construction.

The development of new technology and increasing productivity requires investment in R&D and IP. If firms cannot capture the benefits of innovation and IP for some reason, because of imitation, piracy or secure supply of materials for example, they will not invest in innovation. Because the traditional tender method does not allow capture of IP and knowledge externalities by contractors, there is a perverse disincentive to innovate. Tendering rules or codes have been developed to maintain the integrity of the bidding process, not to encourage innovation, and a successful tenderer’s scope to be innovative is limited. There is opportunity to maximise profits within the tender price by novel ways of organising work or driving down subcontract prices, but bidders are not asked to put forward design suggestions, there are no criteria for evaluation of novel proposals, and tenderers cannot be treated equally if one is preferred on an alternative tender, which is non-conforming in terms of the original invitation.

The answer often proposed is that the best way to increase innovation lies in changing the methods and systems used to procure building and construction projects. If contractors can make novel proposals to owners, productivity can improve, and society benefits from innovation. With non-traditional procurement methods such as design and construct (D&C), build, own, operate (BOO) or build and maintain (B&M), this disincentive is reduced because contractors can appropriate benefits of innovation and R&D through improved performance.

It may not be that simple. If all firms have access to the same technology, and compete through continual, but gradual, improvement, they are subject to a ‘ratchet effect’. First identified in the 1930s by sociologists studying workers subject to performance pay, they found workers choose to restrict their output because they rationally anticipate that employers will respond to higher output by raising output requirements by cutting piecework pay or worker incentives within firms. It was also an unintended consequence of Soviet planning. If a factory met or exceeded its planned target, the target for subsequent years was increased, thus reducing incentives and effort for the factory manager.

In construction the ratchet effect can be seen in bidding for projects, where tenderers will typically not deviate far from a client’s expected cost for the project, and all tenderers have access to the same information. Because of the ratchet effect, a firm avoids revealing a significant cost advantage on one project that might jeopardise margins on future projects. Importantly, it allows for innovations that improve productivity and efficiency, that are neither disruptive nor expensive to contractors but will deliver a windfall gain if a project comes in well under budget, which will be hidden from the client and competitors as much as possible. This suggests that there will be cost-reducing innovations available to contractors if they decide to invest, but the pressure to find them will be affected by client demands, upfront costs, market conditions and a competitor’s likelihood of using them. [1]

Also, clients avoid risk associated with innovation on their projects and do not include it in their budgets. Clients can act as a significant barrier to innovation because they are concerned about both construction costs and operating costs, and do not think they individually will benefit significantly from a successful innovation. Further, clients carry a significant share of innovation risk and as a result do not take on the risks of budget and time overruns or poor building performance, and other costs associated with innovation. This risk minimisation objective also applies to financiers and insurers of construction projects.

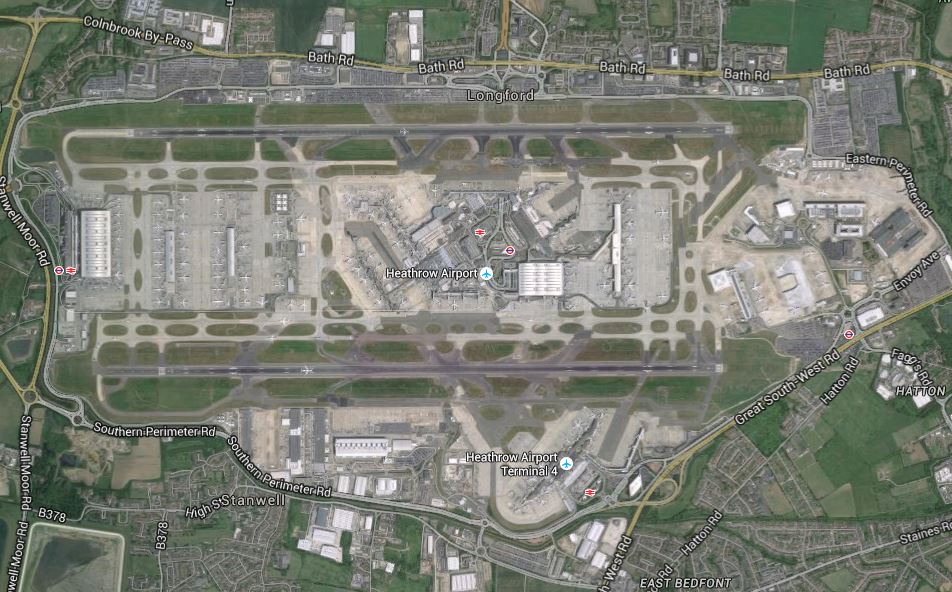

While this argument might be generally true, exceptions prove the rule. An example is the Heathrow Terminal 5 (T5) project. This project demonstrates the effect a determined client with a clear strategy to encourage innovation in order to improve performance can have. In its role as the client BAA took on all the risk for the ₤4.3 billion project, under the unique T5 Agreement that the 60 first tier contractors signed. In total, 15,000 suppliers were involved. The overall project was divided into 147 sub-projects, with an integrated team led by BAA responsible for each one. Unlike the majority of megaprojects, T5 was delivered on time and on budget.

The key relevant point about T5 was that innovations were actively sought out and rewarded. These included product innovations in offsite fabrication such as the roof structure, technological innovations such as the tunnelling process and equipment, process innovations such as the two logistics centres and management innovations in the industrial relations, insurance provisions and supplier incentives built into the T5 Agreement.

The risk associated with large, complex projects can provide the motivation for clients to pursue and reward innovation by major contractors and suppliers, who on T5 demonstrated a capability for innovation that is left unused under traditional tendering and procurement methods. However, most construction projects are less complex, many are standardized and repetitive, and clients have no reason to support innovations that might marginally affect their project’s delivery or performance but increase the risk of cost overruns. Construction is in a catch-22 situation, where neither industry incumbents nor its clients can rationally commit to significant, expensive investments in innovation for the vast majority of construction projects.

The traditional procurement method does not allow capture of IP and knowledge externalities by tenderers. Therefore, many believe the best way to increase innovation lies in changing the methods and systems used to procure building and construction projects, but while there will be cost-reducing innovations available to contractors if they decide to invest, the pressure to find them will be affected by client demands, upfront costs, market conditions and a competitor’s likelihood of using them. As a result, innovation is difficult, though not absent.

[1] Given a variety of locations with different relative prices, there will be a best location for supply of the most productive factor. Therefore, firms can raise productivity by moving to a site with a larger supply and lower relative price of the most productive factor, so for any one location there will be a better technology in use somewhere else (but with different relative prices). However, firms face search and switching costs when looking for new technology, and sunk costs in adopting one.