US Survey Data and the Construction Industry

The previous post was on the United States Census Bureau Annual Business Survey (ABS). In 2018 the ABS included a technology module with three questions about the extent of technology use between 2015 and 2017: the availability of information in digital format (digitization), expenditure on cloud computing services, and use of a range of advanced business technologies. The first results were released in a working paper from the National Bureau of Economic Research in January. There were 583.000 responses to the survey, and two thirds of the firms employed under 10 people and were less than 20 years old.

The survey links technologies across firm size and age categories, as well as the co-presence patterns for the technologies at the firm level. It also identifies which technologies are in the early stages of diffusion as indicated by the rates of testing versus the rates of actual use of technologies by firms. The survey shows construction is not significantly lagging other industries in the US in digitization and use of cloud services, however it is doing less testing and development of advanced business technologies.

The main finding of the survey was “Despite increasingly widespread discussion in the press of machine learning, robotics, automated vehicles, natural language processing, machine vision, voice recognition and other advanced technologies, we find that their adoption rates are relatively low. Furthermore, adoption is quite skewed, with heaviest concentration among a small subset of older and larger firms. We also find that technology adoption exhibits a hierarchical pattern, with the most sophisticated technologies being present most often only when more-basic applications are as well.”

Size and number of firms in US construction

The structure of an industry is the number of firms categorized by size, typically the number of employees. Firms are classified as small, medium or large, with the numbers used varying by country and industry, as the tables below show. Data on firms (often called enterprises in the statistics) is presented using the International Standard Industrial Classification. Section F in ISIC includes the complete construction of buildings (division 41), the complete construction of civil engineering works (division 42), and specialized construction activities or special trades, if carried out only as a part of the construction process (division 43). Also included is repair of buildings and engineering works. Although there are national variants on the Standard Industrial Classification format SIC codes therefore represent industries, and firms are classified (or often self-classify) to industries on the basis of common characteristics in products, services, production processes and logistics.

In the US the Census Bureau collects data on industries and enterprises, the latest data for 2012. The website has this notice: “Due to limited resources and competing priorities of critical programs within the Census Bureau, the Enterprise Statistics Program has been suspended.” Reflecting the scale of the American economy, the size range of firms is much greater than the EU and the largest firms much larger. Over 95 percent of US firms are small, in this case with less than 100 employees, and have on average five or six employees. However, there were 212 firms with 1,000 or more employees that had a total 630,000 employees, of which nearly 160,000 were employed by the nine largest firms.

Table 1. US Construction 2012

Enterprise employment size | Number of enterprises | Sales or revenue $1,000,000 | Annual payroll $1,000,000 | Number of paid employees |

All enterprises | 581,601 | 1,349,346 | 260,606 | 5,006,131 |

Less than 100 employees | 576,272 | 812,924 | 154,461 | 3,336,286 |

100 - 499 employees | 4,788 | 226,818 | 46,899 | 817,823 |

500 - 999 employees | na | 82,320 | 14,787 | 222,481 |

1,000 - 2,499 employees | 141 | 79,475 | 14,968 | 211,141 |

2,500 - 4,999 employees | 45 | 62,749 | 10,516 | 145,875 |

5,000 - 9,999 employees | 17 | 38,072 | 7,497 | 113,133 |

10,000 employees or more | 9 | 46,988 | 11,476 | 159,392 |

Source: US Census Bureau 2012, table 2; na is not available due to sampling issues.

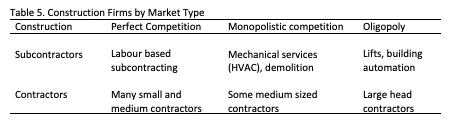

The data, which emphasises the number of firms, is deceptive because of the very large number of small firms the entire industry is often characterized as unconcentrated. Viewing the construction industry as predominantly made up of small firms supports the view of the industry as fragmented with the characteristics of perfect competition. That description is too broad, some segments are much less fragmented than others. Competition among large contractors and among specialty supplier firms is oligopolistic, while small contractors are closer to perfect competition. There are few significant barriers to entry to the construction industry for small firms, so labour-intensive subcontractors and small contractors can be assumed to operate under perfect competition. There are relatively few contractors capable of managing large projects, and the barriers to entry at this level in the form of prequalification are significant, based on track record, financial capacity and technical capability.

Technology testing and diffusion

The testing-versus-use rates across different technologies are used to assess which technologies are in earlier phase of diffusion, that is, where testing is high relative to use. From the survey data the Construction industry is neither a leader nor a laggard in the availability of information in digital format. Manufacturing, Information and Professional Services are the industries with the highest rate of adoption of digitization, with firm size the primary correlate of adoption. For expenditure on cloud computing services Construction is lagging, with use rates below the average and well behind Professional Services. Overall, cloud services purchases have much lower diffusion rates compared to those for digital information. On these two questions of digitization and cloud usage Construction is comparable to the Agriculture, Retail and Transport industries on the extent of adoption, which is significantly lower than the rate in Information, Professional Services and Health Care industries.

Where Construction is well behind is in the testing and use of a range of advanced business technologies. The butterfly chart below shows sectoral diffusion rates for all business technologies considered together. Manufacturing leads with about 15% of firms indicating use of at least one business technology, followed by Health Care (14%), Information (12%), Education (11%) and Professional Services (10%). The lowest diffusion rates for the technologies are in Construction, Agriculture, Mining and Utilities, Management and Administrative, and Finance, Insurance and Real Estate sectors.

Figure 1: Extensive and Intensive Margin Measures of Use and Testing Rates for Business Technologies by Sector

Across all AI-related technologies, the aggregate adoption rate for all firms in the economy was 6.6% meaning that approximately 1 in 16 firms in the US were utilizing some form of AI in the workplace. The AI adoption rate varies greatly by firm size. Adoption rates (defined as usage or testing) increase from 5.3% for the group of firms with the smallest number of employees to 62.5% for firms with 10,000+ employees. Scale appears to be a primary correlate of AI usage, and its use by large firms means the employment-weighted adoption rates (estimates of the fraction of workers employed by firms using the technologies for advanced business technologies) are five times higher than the firm rates (i.e. because large firms are using AI the number of employees working with AI is five time greater than the number of firms using AI). There is increasing concentration of both employment and advanced technology adoption in fewer, larger firms.

The analysis finds “In general, the business technologies explored in the module’s third question are more prevalent in larger and older firms. This skewness in technology prevalence suggests that these technologies may have a disproportionate economic impact despite their generally low adoption rates’ and “This may potentially have far-reaching implications on topics such as inequality, competition and the rise of “superstar” firms, especially if AI is shown to have widespread productivity benefits. If only a select group of firms are able to fully realize the benefits of AI, we can expect further divergence for the “frontier” and most productive set of firms.”

From table 1, in the US in 2012 there were 9 construction firms with 10,000 employees and 17 with 5-10,000 employees, employing nearly 280,000 people between them (out of 580,000 firms and 5 million employees). Although there will be small, young firms experimenting with AI and other technologies, the data suggests some of these large firms will be investing in advanced technologies like AI, robotics and augmented reality at a scale the rest of the industry cannot. This has already been seen with the use of BIM, which is spreading to smaller firms in the industry a decade after many larger firms began the process of implementation. Another example is the way some large contractors are already running their own platforms for procurement and project management, which their suppliers and subcontractors have to use. These are closed, internal platforms. However, there are also open platforms developed by digital systems integrators such as Project Frog.

It seems clear that digital platforms providing building design, component and module specification, fabrication, logistics and delivery will become widely used. Platforms provide outsourced business processes, usually cheaply because they are standardized, and are available to large and small firms. Also, platforms use forms of AI to monitor and manage the data they produce, the function of intelligent machines. Examples are Linkedin (matching jobs and people), Skype (simultaneous translation of video calls), AWS and other cloud-computing providers, and marketing, legal and accounting software systems. Such cheap, outsourced, cloud-based business processes can lower fixed costs and thus firm size, because firms can focus on their core competency and purchases services as necessary as they scale, leading to more entry and more innovation.

Table 2. Dimensions of Development

Dimensions | Construction and the fourth industrial revolution: Possible developments |

Production of components and materials | Platforms integrate design and production with full visualisation of voice-controlled 3D models of buildings, components and location. Selection of components and modules from online design libraries, both open-source and private. Developments in digital fabrication, design software and molecular engineering allow a range of new production technologies to spread through the industry. Economies of scale for on-site versus off-site production will determine where and what components are produced and how. |

Mechanization and automation of tasks | Site workers have exoskeletons and smart helmets available. Many on-site tasks can done by teams of robots and/or machinery and equipment, operated remotely with some autonomy. Assemblers can be designed and fabricated to install components and modules, which can be designed to be handled by assemblers. |

Organization of projects | Cloud based platforms integrate delivery of the physical project with its digital model, with real-time data and monitoring of activities and tasks. Standardized, outsourced cloud-based business processes are used, so contractors focus on integration of site work, site production and component assembly. |

In the various forms that advanced technologies take on their way to the construction site, they will become central to many of the tasks and activities involved. In this, building and construction may no different from other industries and activities, however the development path in construction will be distinct and different from the path taken in other industries. This path dependence can vary not just from industry to industry, but from firm to firm as well. Because the construction industry’s technological system of production is so wide and deep this will affect a large number of firms and people, and through them the wider economy and society. Invention and innovation based around BIM, digital twins, cloud computing, digital fabrication and advanced manufacturing technology, will fundamentally affect the production system through economies of scale and scope.

Advanced Technologies Adoption And Use By U.S. Firms: Evidence From The Annual Business Survey, by Nikolas Zolas, Zachary Kroff, Erik Brynjolfsson, Kristina McElheran, David N. Beede, Cathy Buffington, Nathan Goldschlag, Lucia Foster and Emin Dinlersoz. 2020. National Bureau of Economic Research, Cambridge, MA Working Paper 28290 http://www.nber.org/papers/w28290