Four papers on US statistics and McKinsey’s latest report

The lack of growth in construction productivity is a well-known and universal issue. This post reviews US research into construction productivity, with summaries and comments on four recent research papers, followed by the most recent McKinsey report on improving construction productivity. Two papers develop a physical measure of productivity as houses per employee, providing alternative measures to the official statistics.

The first paper discussed argues that increasingly strict land-use regulation has resulted in more small, low productivity firms in residential construction, and this has lowered the overall industry level of productivity. The two papers that follow looked at problems in the statistics and methods used to measure it, and found strong evidence that mismeasurement does not explain the lack of productivity growth. The fourth paper also addresses issues in the statistics and develops four deflators for four specific construction sub-industries.

The McKinsey report starts with industry level analysis, then goes on to address project level issues. It lists seven issues in construction that lead to low productivity, and offers five ‘transformative approaches that owners and delivery partners could adopt’.

Why Has Construction Productivity Stagnated? The Role of Land-Use Regulation

D'Amico, L., Glaeser, E., Gyourko, J., Kerr, W., and Ponzetto, G. 2024.

The paper discusses construction productivity in the US and argues land-use regulation has affected the size and productivity of residential construction firms, and uses a new productivity measure using housing units started per employee. They admit this is an ‘imperfect’ series, because the employment data has missing years and excludes some subcontractors, but nonetheless is used in the comparison with manufacturing and car production. Despite the data problems, this is a useful measure of physical productivity (as output per employee) that avoids the issues associated with productivity estimates from official construction statistics

Figure 1. US house building labour productivity 1900-2020

The paper says “From 1935 to 1970, homes produced per construction worker grew at a pace that at times exceeded the growth in the number of cars produced per automobile industry worker or the growth of total manufacturing output per industrial worker. Since 1970, these three series have diverged sharply. Car and manufacturing output per worker continued to soar but houses built per worker fell dramatically.” [1]

Figure 2. Construction compared to manufacturing and cars

In the 1950s the US developed new towns and suburbs with thousands of houses, using a production line method that moved site workers from one building to the next in a highly coordinated system integrated with the supply of materials. D’Amico et al. suggest such large scale developments with their economies of scale cannot be done today, due to the “increase in regulatory tightness in construction from the mid-1970s to today. Developing large projects and coordinating construction teams over different projects all working at the same time is becoming more and more difficult … It is also hard to obtain permits to develop a single type of housing unit on large plots of land given that zoning laws discourage such types of projects.”

The argument is that land-use regulations affect firm size by reducing the average size of home builders, and firm size restricts returns from scale and diminishes incentives to invest in technology [2]. With reduced technology investment comes lower productivity: “Project-level regulations have been put in place that reduce innovation, not by barring it, but by limiting project and firm size. The small scale of the firms, and the fact that they could not grow dramatically even if they made a breakthrough, then limits innovative activity.”

They argue there will be less construction activity in areas with stricter land use regulation, because stricter regulation leads to smaller establishments and forces contractors to undertake many small projects. This stretches their span of control, creates inefficiency and causes lower productivity. Therefore, in more regulated areas residential construction firms will be smaller and less productive.

Their econometric model links project-level regulation, firm size and productivity, and they suggest firm size could explain a significant fraction of the low productivity seen in American residential construction. For bigger firms, fixed costs are relatively less important and productivity is higher. Smaller firms are less productive and in jurisdictions where regulation is more intense, average firm size and firm productivity are both lower.

Using the model, there is a detailed analysis of residential construction firm productivity, with regressions against regulation, size, revenues, housing units produced, and profits. For regulation the Wharton Residential Land Use Regulation Index is used, and the model finds a one standard deviation increase in the Index is associated with an 12.8 % reduction in revenue per firm, a 5.4% decrease in revenue per employee, and a 4.3% reduction in employment in large building firms’

Comment

This is an interesting paper built on the well-known fact of lower productivity in smaller firms. The intuitively appealing argument is that increasingly strict land-use regulation has resulted in more small firms doing more small projects. Using regression analysis they find this is has indeed been the case in the US sine the 1970s, when construction productivity stopped growing.

However, does stricter land-use regulations lead to smaller firm sizes, and therefore lower productivity, in construction? The answer is more maybe than definitely, for two reasons. First, the comparison with the 1950s and 1960s house building boom is misleading. That period was uniquely different because of the size of the sites available and repetition of a large number of houses, in many places developments had over 10,000 houses built over a few years. Those sites are no longer available and developments of that size are not possible today. That is not due to regulation, but because the opportunities are not there.

Second, construction is a local business, There is a physical limit to managing projects based on the time and cost constraints of distance. Small firms work within their local area, and larger firms typically operate as a series of semi-independent project offices. Regulation might enhance the effect of location through local planning laws, but does not create the diseconomies of distance.

Finally, does project-level regulation reduce incentives to invest in technological innovation? The paper does not provide any evidence for that beyond firm size, but it is a well-known characteristic of small firms that they do not invest in innovation and have limited capex budgets. That is because they are small, not because they are over regulated.

The paper links regulation, firm size and productivity. Basically, land-use regulations reduce project and firm size, leading to smaller and less productive firms. The analysis finds some support for that argument, because there is less building in places where regulation is more intense, but there are other good reasons why there are so many small residential construction firms. This is original research, but does not conclusively prove increased regulation is responsible for the prevalence of small firms in house building in the US.

The Strange and Awful Path of Productivity in the U.S. Construction Sector

Goolsbee, A. and Syverson, C. 2023.

This paper is from two experienced researchers into the construction industry, and they look at several key issues in measurement of productivity. Their intent is to show that the lack of growth in construction productivity is not due to problems in the statistics or method used to measure it. The time period covered in their research is 70 years, from 1950 to 2019.

They focus on measurement problems as an explanation of poor performance: ‘we update some of this previous work and extend it to some new data sources and hypotheses. Together, these new approaches seem to reinforce the view that the poor performance is not just a figment of measurement error.’

First, mismeasurement of capital stock or labour inputs is not the problem. They find both capital intensity (capital stock per full time employee) and intellectual property have grown at rates comparable to the whole economy since 1970. The growth rate of labour inputs was lower after 1970 than before, not faster as a mismeasured productivity slowdown would imply. Therefore, the problem should be in measuring output.

Second, in the US, construction’s nominal value added has grown at a similar rate to the economy, but the construction output deflator and the GDP deflator start to diverge in the late 1960s: ‘From 1950-69, the average annual growth rates of the construction and GDP deflators were almost identical—2.40 percent and 2.42 percent. From 1970 on, however, the GDP deflator averaged annual growth of 3.37 percent, while the construction value added deflator grew 5.47 percent per year.’

By deflating nominal construction activity with the whole-economy deflator, construction productivity will look like overall productivity. Is this the smoking gun? Unfortunately, no. The issue here is the change in relative prices, which is the price change of inputs in construction compared to the changes in overall prices in the GDP deflator. They find the increase in the construction price deflator cannot be explained by increasing relative prices of construction inputs.

They then measure productivity in physical units in residential housing construction, using units per employee and square feet per employee for houses and apartments. These also show declining or stagnant productivity, although the multi-family series are extremely variable, falling by half in 2001 and 2010 during economic downturns.

Figure 3. US house building labour productivity 1972-2020

Finally, they consider construction’s ability to transform intermediates into finished products. Again, performance has deteriorated. They also provide evidence that something keeps producers in areas where construction is more productive from growing, and ‘this problem with allocative efficiency may be accentuating the aggregate productivity problem for the industry.’

Comment

By working through the likely suspects of mismeasurement of capital and labour inputs, output and the deflator used to adjust for price changes, the paper finds that measurement error is ‘probably not the sole source of the stagnation’, i.e. the statistics may have some issues, but the problem is real. Using alternative measures like the physical measure of housing units produced per employee and the use of intermediate inputs also finds no increase in productivity.

Construction productivity, despite the improvements in materials, tools and techniques over the last few decades, has not increased. And this is not unique to the US, for countries around the world, the same result has been found.

Can Measurement Error Explain Slow Productivity Growth in Construction?

Garcia, D. and Molloy, R. 2022.

Garcia and Molloy are economists at the US Federal Reserve, and for them the answer was no: ‘we estimate that productivity was essentially flat in the construction sector from 1987 to 2019.’ However, it was not as low as the negative -0.05% annual change found by official statistics when they adjusted for what they call ‘unmeasured structure quality’ of houses. Quality changes were improved energy efficiency, better finishes, more bathrooms and larger buildings. These improvement were real but ‘undramatic’, and adjusting for improved quality gave an annual increase in productivity of 0.02%.

Their analysis found a small upward bias in deflators related to unobserved improvements in structure quality, ‘but the magnitude is not large enough to alter the view that construction-sector productivity growth has been weak. We also find only small contributions from other potential sources of measurement error.’ They conclude construction is very labour-intensive and there have not been many labour-saving innovations due to low investment in intellectual property.

They found the average length of time from start to completion of single-family homes increased from 6.2 months in the mid-1980s to 7.0 months in 2019, ‘suggesting that any time-saving productivity improvements have been more than offset by delays elsewhere in the construction process.’ Although this could be due to increased regulation causing delays, they did not find evidence for increased costs from regulation.

Another potential restraint on productivity growth is more construction taking place in already dense areas: ‘new homes built between 2016 and 2019 were more likely constructed in tracts with a population density above 3000 persons per square mile, while new homes built between 1991 and 1994 were more likely to be built in tracts with less than 100 persons per square mile’. Higher density makes building on small parcels of land more expensive because it is more difficult to take advantage of scale, compared with large developments of hundreds of new homes.

Comment

The result of this research is that a small increase in productivity has been absorbed by higher but unobserved (i.e. not in the data) quality, therefore there has been no growth in measured construction productivity since 1987. Using a variety of sources on building quality, land and house prices, and potential bias in the deflators from measurement of output and labour input, their adjusted measure finds a small average annual increase rather than the small annual average decrease in official statistics. While something is better than nothing, the gap between construction and other industries’ productivity growth remains.

Measuring Productivity Growth in Construction

Sveikauskas, L., Rowe, S., Mildenberger, J., Price, J. and Young, A. 2018. Updated 2024.

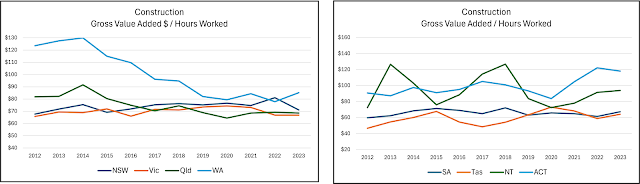

Addressing the problem of measuring real output in construction, Sveikauskas and his colleagues at the US Bureau of Labour Statistics estimated real construction value added per hour worked in four construction sub-industries, using four specific deflators and including subcontractor hours. The research methods were published in 2018.

Using more recent data for a time period comparable to the papers discussed above, between 2007 and 2020 productivity fell in single-family residential and multiple-family housing construction, but rose in industrial and highway, street, and bridge construction, following a rising volume of work in the latter two sub-industries. Overall productivity for the four sub-industries was flat because these rises and falls balanced out.

Figure 4. Productivity for four construction sub-industries

Source: Bureau of Labor Statistics,

Comment

The BLS research addresses the deficiencies found in construction deflators. There is a downward bias to output estimates because there is no adjustment for quality changes in buildings and structures. If real construction value added is underestimated due to the deflators used, construction productivity has also been understated.

These estimates used four different deflators, providing high quality estimates of real construction value added per hour worked in those industries, including subcontractor hours. The BLS research improves on previous research by using appropriate output deflators to develop measures of productivity growth, these measures are more reliable because the deflators are specifically designed for each sub-industry. The 2024 update for 2019 to 2023 shows labour productivity falling for single family residential and highway and bridge construction, but rising for multi-family residential and a large increase in industrial construction productivity.

Construction Productivity is No Longer Optional

Mische, J., Stokis, K., and Vermelfoort, K. August 2024

The article starts with data on the lack of growth in labour productivity, defined as the value added per hour of work, adjusted for increases in construction and input prices, for 42 countries with about 90% of construction value added. McKinsey has released a series of report on construction productivity since 2017, and this latest addition updates the data without changing the picture of lower growth in construction compared to other industries. [3]

Figure 5. Construction compared to manufacturing and global economy

There are seven specific issues holding back measurable productivity gains (links below are in original):

1. The construction industry’s uptake of technology has been slow over the past several decades. Historically, construction companies spent an average of less than 1 percent of revenues on IT, less than a third of what is common, for example, in automotive and aerospace. Technological innovations in construction largely focus on increasing control or other priorities, such as design, safety, and usage of new materials, and less on direct workforce productivity

2. Improvement in projects don’t scale across the entire project portfolio. Companies typically start projects as soon as possible with a smaller team that focuses on technical aspects, procurement, and project deliveries rather than on improvement initiatives. Projects have little incentive to act as the pilot for the benefit of future projects.

3. In some cases where the industry has improved its productivity and where construction companies could have improved their margins, many of these benefits are passed upward (to suppliers) or downward (to their customers) in the value chain. tender teams factor gains from productivity into cost estimates within proposals, keeping margins thin

4. Tender dynamics and low margins limit investment in productivity.

5. Current approaches to risk-sharing and cost estimation cannot keep up with the ever-growing increase in project complexity, risk, and scope.

6. Productivity declines because of firms having to bring inexperienced workforces onto projects. A large part of skill level is built on tenure and apprenticeship. New workers may require additional training and control and, consequently, achieve lower rates of productivity.

7. Timely delivery takes priority over productivity improvements. Reducing idle times across all subcontractors and tasks while meeting throughput requirements would require systemwide efforts to improve workflows, reduce bottlenecks and variability, balance loads, and improve project production rates.

The transformative approaches that owners and delivery partners could adopt are quoted in full:

- Adopt project steering 2.0. Conventional project management relies on earned-value-management systems, but these s-curves can disguise performance issues and delay intervention, enabling further cost and schedule delays. Project teams can follow the lead of manufacturing and shift their focus to production rate metrics, such as meters welded, volumes excavated, and drawings reviewed. Steering projects in this way will allow teams to be more proactive and help them resolve issues before they materialize.

- Nurture a supplier ecosystem across projects. Supplier ecosystems can help delivery partners provide owners with transparency, credibility, and predictability by providing teams more stability, which will help improve learning curves, interfaces, ways of working, and innovation. Instilling habits across an ecosystem can build the trust and better practices required to gradually promote positive end-to-end change across projects.27 Owners will typically set up these partnerships and role model the desired way of working.

- Upskill project staff. Skilled labour shortages pose a massive upskilling and leadership challenge for the industry. Given high-pressure and short timelines, project staff are tempted to fall back on suboptimal behaviours and ways of working. Leaders can foster an aptitude for learning among their teams to help team members upskill regularly. Technology-supported learning journeys, systematic apprenticeships, and project academies focused on hard and soft skills will all become more popular in years to come.

- Scale initiatives across project portfolios. There are many examples of successful productivity improvements within specific project teams. However, rolling out improvements across a project portfolio is difficult. Change management in a project portfolio context is even harder than in an individual project. Tailored approaches and different capabilities are needed to establish improvement at scale.

- Apply technology in ways that have a direct impact on productivity. Technologies such as generative AI could fundamentally transform how capital projects are delivered. Investments in technology should shift from the “shiny objects” like drones or monitoring software to technology that streamlines and accelerates engineering, procurement, and construction.

Comment

The McKinsey report does not specifically address residential construction, which has been the focus of the other research discussed above. However, the issues and recommendations apply as much to house builders as to larger contractors in non-residential construction who are more likely to be McKinsey clients. Their seven issues are common to construction companies everywhere. As McKinsey notes, productivity is not how companies measure the success of projects, and ‘companies prioritize hitting the delivery date over any other goalpost.’

Their recommendations are less ‘transformative’ than statements of the obvious. These are all well-known and widely appreciated, and have been discussed in government reports and the academic literature for decades. The problem for the industry is that all these ‘transformative approaches’ require upfront investment that clients do not, and will not, cover (including government), and few contractors have the scale necessary to spread those investment and capital costs across enough projects to make them feasible. And for those companies, profits do not always a follow the investment.

A more germane question, that McKinsey does not answer, is why it is so difficult for so many construction companies to make their recommended changes if they would improve margins and profits? This is the core issue: what or where is the new business model that construction companies can use that will both improve productivity and increase profitability. How do companies benefit from these changes?

Conclusion

A recent paper on the lack of productivity growth in US construction by D’Amico et al. argued increased regulation leads to more small, low productivity builders in residential construction. However, the structure of the residential construction industry is many small firms working on small projects and contracts in a local area, but the authors do not consider the possibility that industry structure is aligned with this demand pattern.

Other recent research into construction productivity growth in the US has focused on issues with the statistics used to measure it. That is because problems in measurement and particularly deflation of output are widely accepted reasons for the low rate of growth. The research is thorough and approaches the problem in several different ways, and concludes that while there is some mismeasurement that understates growth, it does not account for the lack of growth in the long-run.

Goolsbee and Syverson looked at potential mismeasurement of capital and labour inputs, output, and the deflator used to adjust for price changes. They find the statistics may have some issues, but the problem is real. Using a physical measure of the number of housing units produced per employee also finds no increase in productivity.

Garcia and Molloy found a small increase in productivity since 1987 in their adjusted estimate, but it has been absorbed by higher but unobserved quality that is not included in the data, such as larger houses, better finishes and improved energy efficiency. Therefore, there has been no growth in construction productivity as measured by official statistics.

Sveikauskas et al. estimated real construction value added per hour worked in four construction sub-industries, using alternative deflators specific to the four types of building. Their estimates found growth in two of the sub-industries but declines in the other two, thus no growth in overall productivity as these rises and falls cancel each other out.

McKinsey’s prescription for transformation of the industry has a focus on projects, technologies, and information, in a top-down approach that has to date not delivered any meaningful changes in the industry or productivity. McKinsey does not address why it is so difficult for construction companies to make their recommended changes, or how they improve margins and profits. What or where is the new business model that construction companies can use to improve productivity and increase profitability?

That construction needs to improve productivity is something all industry stakeholders can agree upon. Despite all the time, effort, and words expended on this over many decades there has been no increase in industry-wide productivity. There is good evidence for differences between firms [4], with large firms having significantly higher productivity than small ones, but the great majority of firms are small and many are doing labour intensive repair and maintenance work. This structural characteristic of the industry has and will continue to limit growth in construction productivity.

*

[1] A previous post argued against comparison with manufacturing.

2] Ed Glaeser has done previous research on this, in Glaeser, E. L. and Ward, B. A. 2009. The causes and consequences of land use regulation: Evidence from Greater Boston. Journal of Urban Economics, 65(3):265-278. See here for Gyourko, Saiz, and Summers, 2006, on their Wharton Residential Land Use Regulatory Index.

[3] The article uses data for 42 countries that represent about 90 percent of construction’s global VA. Sources used include the International Labour Organization, IHS Markit and S&P Global, the OECD, the United Nations, and national statistical agencies, such as the National Bureau of Statistics of China and the US Bureau of Labor Statistics.

[4] A 2024 post on Australian firms noted ‘large firms are less than one percent of the number of firms, they employ 14 percent of the people and produce 21 percent of industry value added. Medium and large firms have much higher levels of productivity, measured as IVA per employee. For large firms this is $195,000, nearly twice the micro firm IVA per employee of $100,000.’

Subscribe on Substack here