Construction of the built environment has an interlocking set of economic, political, legal, and social barriers that make innovating difficult. As long as current technology meets the expectations of clients and users for prices and dominant products, there will be significant market imperfections such as network economies, lumpiness, split incentives, requirements for collective action, and transaction costs that inhibit diffusion of more efficient, advanced technologies. There is also an institutional structure that imposes regulatory hurdles or other policy disadvantages, favours existing technology or discourages new entrants, and a financing system based around incumbents. Educational curricula, career paths, and professional standards use existing technology. And because organizations, people and technical standards are embedded within a production system, the tendency is for technologies to develop along defined trajectories unless or until deflected by a powerful external force.

Construction of the built environment is a project-based system of production with complex professional, organizational, contractual and working relationships, and is geographically distributed. Moreover, the context is one of wider networks containing many small and medium size firms with a range of organizational and institutional relationships, where external contracting is common. All these factors are seen as inhibiting, although not preventing, innovation and diffusion of new technology. Within such a system incremental innovation improves industry products and processes without affecting the structure of the system.

In construction, many technical advances have come from materials suppliers or component, plant and equipment manufacturers, who have been responsible for the introduction of new products and equipment, such as excavators, cranes, facades and lifts, using incremental innovation directed at improving existing products and processes. Across the construction supply chain firms don’t create new industrial networks to develop or exploit new technologies such as lifts and elevators, glass facades, and interior wall systems, instead these firms become part of the existing network, which is the modern construction production system. As a well-developed industrial system many of its sub-markets are expected to be concentrated and oligopolistic, with a few large, well-established firms exactly like those economic historian Joseph Schumpeter suggested would be most likely to engage in R&D, invention and innovation.

The process where inventions are developed, tested and extended, and finally put into production is one of incremental innovation. Firms refine specific parts of a production system, usually in response to something changing elsewhere in the system as production and distribution methods evolve over time, step by step. Although this form of innovation is incremental, it should not be dismissed as unimportant. Examples are the increase since 1950 of mining truck loads from 4 to 400 tonnes and the increase in lifting capacity of tower cranes to over 1,000 tonnes. Another example is the development of computer-aided design (CAD) software, which went on for two decades before Autodesk was started in 1982, one year after the first IBM PC. Over the decades Building information models (BIM) have advanced through 2D and 3D versions to the 4D (schedule) and 5D (cost) iterations today. Now software linked to cameras on helmets or drones can provide real time augmented reality (AR) images from a building site linked to the BIM model of the project.

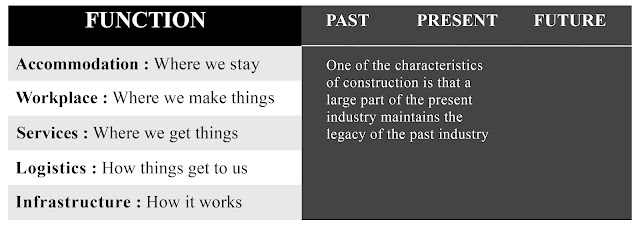

Building and construction products and processes are the outcome of a long development path. Many of the industry’s global leaders are well-established, Bechtel for example is over 100 years old, and other firms like Hochtief, Skanska, and AECOM can trace their origin stories back over a similar period. Shimizu is over 200 years old. Most of today’s manufacturers also have their roots in nineteenth century firms. It’s a remarkable fact that construction today is a production system that has been developing for more than 150 years, since the arrival of steam, steel and concrete, using incremental innovation to gradually improve products and processes.

In the industry life cycle, after emergence and the initial growth stage, technology stabilises around standardised products and processes. In many cases industries are oligopolistic, with a few specialized firms in market niches or layers in the supply chain. Consolidation leads to industry concentration with large firms dominating their markets, the car industry is an example. Construction materials like cement, concrete and glass, and components like building management systems, interior walls, plumbing fixtures, lifts and elevators are all oligopolistic industries in an established supply chain.[i]

Incremental Innovation: The example of concrete

The development of concrete is an example of how effective incremental innovation in construction can be. By the 1880s the increasingly widespread use of concrete had changed its status from hobby to a modern industry, as scientific investigation into its material properties revealed its shear and compressive characteristics. With the development of reinforced concrete there was change in architectural concepts of structures and approaches to building with concrete. The industrial standards of concrete technology influenced ways of thinking based on building systems and standardized building elements. These became identified with what was known as the Hennebique System, a simple to use system of building with reinforced concrete columns and beams patented in 1892. By 1905 Hennebique’s system had spread across Europe and elsewhere and his company employed 380 people in 50 offices with 10,000 workers onsite.[ii]

Concrete then set the agenda for the development of construction as a technological system over the next hundred years driven by the modernist movement in architecture, as it explored the possibilities of these material for increasing the height and scale of buildings, and modern construction materials and methods.[iii] For over one hundred years, since Hennebique, there has been ongoing refinement and development of the world’s most widely used construction material, as shown in Table 1.

Concrete shows how incremental innovation in materials played a significant role in the reorganization of site production methods as mixers, pumps and chemicals were refined and developed in a long process of interconnected innovations. One of the characteristics of a successful technology are these spillover effects, with advances in one industry leading to complimentary developments in related industries.

Table 1. Incremental innovation in concrete since 1800

Source: Jahren, P. 2011. Concrete: History and Accounts, Trondheim: Tapir Academic Press.

Innovation is continuing today with 3D concrete printing (3DCP). Research into 3DCP has focused on developing the equipment needed and the materials used, and by 2019[iv] over a dozen experimental prototypes had been built. By 2022 the commercialisation of 3DCP was underway, with two types of systems available. One using a robotic arm to move the print head over a small area, intended to produce structural elements and precast components, the other a gantry system for printing large components, walls and structures. 3DCP combines BIM models, new concrete mixtures and chemicals, and new printing machines. Again, a combination of new materials and new machinery is required for this technology to work.

In 2022 the Additive Manufacturing Marketplace had 34 concrete printing machines listed, ranging from desktop printers to large track mounted gantry systems that can print three or four story buildings. Companies making these machines are mainly from the US and Europe, and Table 2 also has details on the type and size of a selection of machines. There are also several companies offering 3DCP as a service at an hourly or daily rate.[v]

Concrete printing is only one part of the development of additive manufacturing. In mid-2022 the Additive Manufacturing Marketplace listed 2,372 different 3D printing machines from 1,254 brands. The number of printers and materials used were: 364 metal; 355 photopolymers; 74 ceramic; 61 organic; 34 concrete; 24 clay; 20 silicone; 19 wax; and 19 continuous fibres. Many of these printers could be used to produce fixtures and fittings for buildings. Producing components onsite from bags of mixture avoids the cost of handling and transport, and for large items avoids the load limits on roads and trucks. There are also printing services and additive manufacturing marketplaces being set up. These link designers to producers with the materials science, specialised equipment and print farms capable of large production runs and manufacture on demand. Examples are Dassault Systems 3DExperience, Craft Cloud, Xometry, Shapeways, 3D Metalforge, Stratasys and Materialise.

Table 2. Some companies making 3D concrete printers

Source: Additive Manufacturing Marketplace, 2022.

Conclusion

Innovating in a complex, long established industrial sector like construction of the built environment can be difficult. The institutional architecture can impose regulatory hurdles or other policy disadvantages on new technologies, and government expenditures often support existing technology. Lenders are risk averse. There are subsidies and price structures that favour incumbents and ignore externalities like the environment and public health. Educational curricula, career paths and professional standards are oriented to existing technology. The dominance of existing technologies is further reinforced by imperfections in the market for technology such as network economies, lumpiness, split incentives and the need for collective action.[vi]

The construction industry has become used to incremental innovation and a gradual rate of change since the modern industry emerged over the last few decades of the nineteenth century. At the beginning of the twentieth century there was a great deal of resistance to change: ‘the older assembling industries like engineering were slow to change. Each firm took a proprietary pride in its own work’, and the trades were ‘fearful of technological unemployment and fought all changes in conditions of work.’[vii] Nevertheless, by the 1920s construction had reorganised the system of production around concrete, steel and glass.

[i] Syverson, C. 2019. Macroeconomics and Market Power: Context, Implications, and Open Questions, Journal of Economic Perspectives, 33, 3, 23–43. Syverson, C. 2008. Markets: Ready-Mixed Concrete, Journal of Economic Perspectives, 22, 1, 217–233.

[ii] Pfammatter, U. 2008. Building the Future: Building Technology and Cultural History from the Industrial Revolution until Today. Munich: Prestel Verlag.

[iii] Cody, J. 2003. Exporting American Architecture 1870-2000, London: Routledge.

Huxtable, A. L. 2008. On Architecture: Collected Reflections on a Century of Change, New York: Walker Publishing Company.

[iv] Sanjayan, N. and Nematollahi, B. (eds.) 2019. 3D Concrete Printing Technology: Construction and building applications. Butterworth-Heinemann.

[vi] Bloom, N., Van Reenen, J. and Williams, H. 2019. A toolkit of policies to promote innovation. Journal of Economic Perspectives, 33(3), 163-84.

[vii] Hughes, T. P. 1989: 495. American Genesis: A Century of Invention and Technological Enthusiasm 1870-1970, Chicago: University of Chicago Press.