Record High in Built Environment Employment

The number of people employed in the 16 industries that make up the Australian Built Environment Sector reached 2.23 million in 2020-21, an increase of nearly 10 percent over the previous year, contributing 17 percent to total employment in Australia.

Figure 1

The largest industry is Construction, which employed 1.2 million people (54%), followed by Property and real estate with 333,000 (15%), Professional services 269,000 (12%) and Building services 206,000 (9%). These four industries include a dozen smaller industry groups, and account for 90 percent of persons employed in construction and maintenance of Australia’s built environment.

Figure 2

The big increase in 2021 was a rebound after the 1.3 percent fall in total BES employment in 2019-20. In all industries, with the exception of Water and Waste, employment fell in 2020, and by over three percent in Property and real estate services. In the post-lockdown recovery employment growth in 2020-21 was strong, at over eight percent in Construction and over six percent in both Building services and Professional services.

Figure 3

In the decade from 2007 to 2017 there was a small increase in total built environment employment, however the rate of employment growth since 2018 has been much stronger. The only industry that has not increased employment is Property and real estate services, but in 2020-21 the other industries all had record numbers of people employed after a significant increase in employment. However, this was an unusually large upturn and much larger than the annual increase in output for these industries.

Figure 4

The average growth rate of total employment in the five years to 2021 has been one percent higher than the 15 year average, at 2.5 percent a year. The highest 5 year average rates of growth in employment were five percent a year in the combined Water supply, sewerage and drainage services and Waste collection, treatment and disposal services, and over four percent a year in Professional services. Also of note is the growth in manufacturing employment after a decade of decline.

Figure 5

The Australian Built Environment Sector

The Australian Built Environment Sector uses data provided in the Australian Bureau of Statistics annual publication Australian Industry, produced from a combination of directly collected data from the annual Economic Activity Survey conducted by the ABS, and Business Activity Statement data provided by businesses to the Australian Taxation Office. The data includes all operating business entities and Government owned or controlled Public Non-Financial Corporations. Australian Industry excludes the finance industry and public sector, but includes non-profits in industries like health and education and government businesses providing water, sewerage and drainage services. The industries included account for around two-thirds of GDP. Industries are groups of firms with common characteristics in products, services, production processes and logistics.

Figure 6

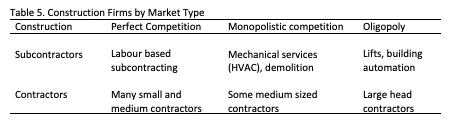

Data on the construction industry captures the onsite activities of contractors and subcontractors. However, onsite work brings together suppliers of materials, machinery and equipment, products, components and other inputs required to deliver the buildings and structures that make up the built environment. Consultants provide professional services such as design, engineering, urban planning, cost planning and project management as inputs into building and construction projects. There are also inputs from transport, finance and legal services, although data for these services is not available.

Other industries like tourism and defence are structured around such value chains and production networks, and when firms from different industries share sufficient characteristics they are described as an industry cluster or sector. In the case of tourism an annual satellite account that combines the industries involved is produced by the ABS.

Table 1. Industries included in the Australian Built Environment Sector

Supply industries | Demand industries | Maintenance industries |

Non-metallic mining and quarrying | Residential property | Water, sewerage and drainage |

Building construction | Non-residential property | Waste collection, and disposal |

Heavy and civil engineering | Real estate services | Building and industrial cleaning |

Construction services | Building pest control services | |

Architectural services | Gardening services | |

Surveying and mapping services | ||

Engineering design and consulting | ||

Manufacturing industries |